The Federal Government’s ongoing initiative to reduce tax burdens and optimise revenue achieved a significant milestone on Tuesday with the government’s approval to exempt small businesses, manufacturers and farmers from paying withholding tax.

This was as it said the National Assembly has received 10 requests to amend tax laws aimed at addressing identified challenges within the current tax regime.

The government also plans to begin full enforcement of these policies by January 2025.

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, disclosed the new information via a post on his official X handle on Tuesday.

Oyedele who leads the committee saddled with the responsibility to introduce a new tax structure in the country to spur economic growth and development, noted that the directive would serve as a way of reducing the tax burden on businesses.

According to the Federal Inland Revenue Service, Withholding Tax serves as a prepayment of Income Tax, deducted at rates between 5 per cent and 10 per cent depending on the transaction.

However, the implementation of the policy has caused pain to manufacturers due to the excessive burden of compliance hampering the productivity of the sector.

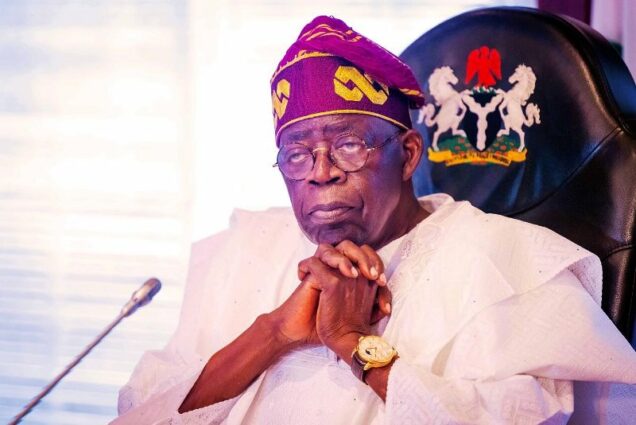

Meanwhile, the Presidential Committee on Fiscal Policy and Tax Reforms has also submitted copies of the new tax policies to President Bola Tinubu and the National Assembly. The President is expected to get the parliament’s approval on the matter.

According to Oyedele, the erstwhile withholding tax system has ambiguity which necessitated the increase in the list of multiple taxes, and inequity.

Small businesses, in particular, faced excessive compliance burdens, straining their working capital.

He said the newly approved regime aimed to address these challenges and introduce several key changes.

SMEs are now exempt from withholding tax compliance, reducing their administrative burden and allowing them to focus on growth.

Oyedele said, “As part of the ongoing fiscal policy and tax reforms, a new withholding tax regime has been approved.

“The key changes introduced are to address the identified challenges and specifically include the exemption of small businesses from Withholding Tax compliance and reduced rates for businesses with low margins.”

He added that key changes were introduced to the previous tax regime as businesses operating on low margins will also benefit from reduced withholding tax rates, easing financial pressures.

He also said the new regime included specific exemptions for manufacturers and producers, such as farmers, supporting the agricultural sector.

He said measures are also introduced to curb evasion and minimise tax avoidance, ensuring a fairer tax system.

The reforms will also simplify the process for businesses to obtain credit and utilise tax deducted at source, improving liquidity.

Oyedele further stated the approved regulations are expected to be published in the official gazette in the coming days.

Explaining further, the tax expert stated that key changes introduced to the rewritten withholding tax regime include; reduced rates for businesses with low margins, measures to curb evasion and tax avoidance, exemption of small businesses from withholding tax, clarity on the timing of deductions and key terms etc.

Others are “Exemptions for manufacturers and producers such as farmers, measures to curb evasion and minimise tax avoidance.