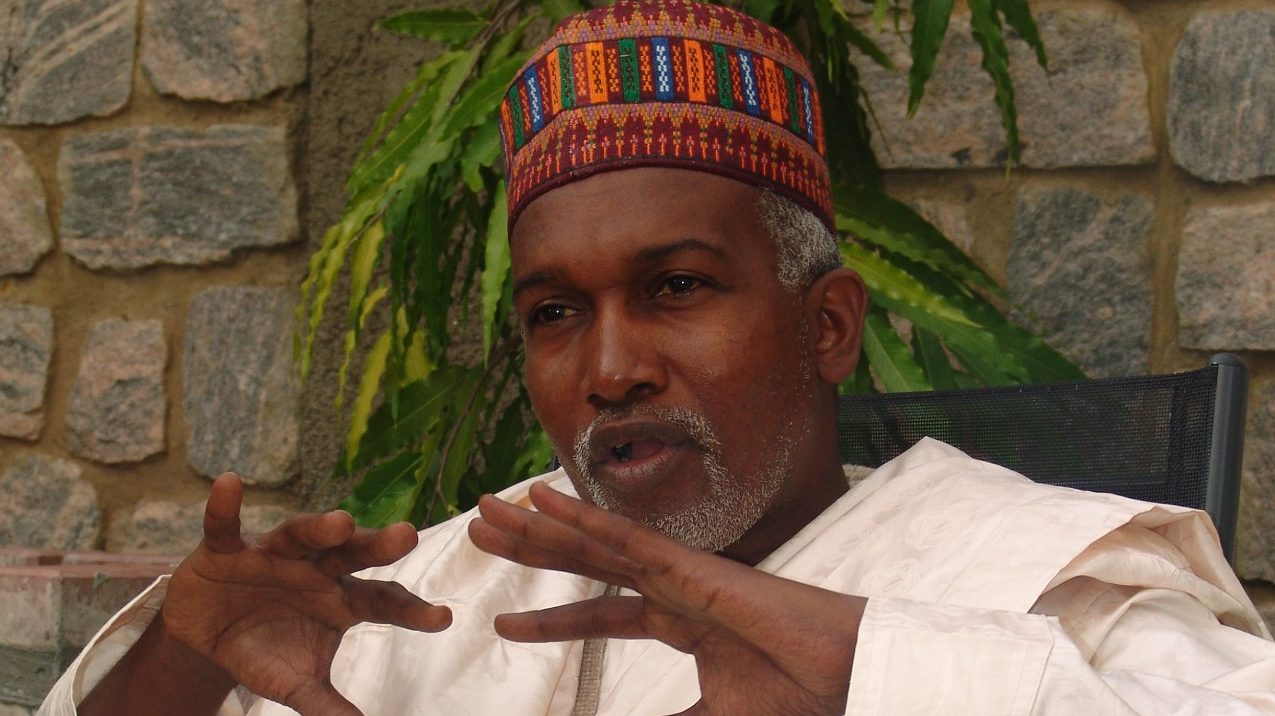

The Minister of Foreign Affairs, Ambassador Yusuf Tuggar, has urged African nations to unite and leverage the abundant mineral resources available across the continent.

He also called for the establishment of an African alliance that brings together both government and private sector stakeholders, with the aim of unlocking the vast potential of Africa’s mineral resources for the benefit of all its citizens.

Tuggar made this appeal during his address at the second ministerial African Natural Resources and Energy Investment Summit held in Abuja Wednesday.

In his speech, he emphasized the primary focus of the summit, which is to unleash the potential of Africa’s extensive mineral resources.

The minister further emphasized the importance of institutionalizing ministerial summits like this to enhance the collective capabilities of African nations.

He stated: “This summit is dedicated to exploring strategies for developing the abundant mineral potential in our various countries and addressing the natural and man-made obstacles that hinder the optimal utilization of these valuable resources. Our objective is to seek potential collaborations and tap into the numerous investment opportunities within the untapped mineral resources sector on the African continent.”

He also affirmed Nigeria’s commitment to active participation in the activities of the ministerial summit and related initiatives, with a focus on fostering deeper and result-oriented cooperation among member countries, aligning with the goals and objectives of the African Continental Free Trade Area.

He stressed the necessity of institutionalizing such ministerial summits to enhance collective capacity.

Tuggar highlighted Nigeria’s unique position as a nation rich in diverse natural resources and expressed eagerness to collaborate and exchange experiences with fellow African nations.

Furthermore, he acknowledged the progress made by some developing countries in transitioning to cleaner and renewable energy sources.

Tuggar emphasized the importance of investing in the expansion of vehicle charging infrastructure and electric vehicle technologies to meet the growing demand for clean energy.

“Nigeria boasts a wealth of natural resources, from precious metals and gemstones to industrial minerals like Barytes, Gypsum, Gold, Kaolin and Marble. This summit provides a platform for sharing knowledge, case studies and experiences from other African countries, showcasing their advancements in this sector, which can benefit our nation.

“The ministerial summit offers a suitable platform to deeply analyze the significant challenges facing natural resources in our countries and to identify appropriate solutions for the short, medium and long term.

“In the energy sector, it is essential to note that some developing countries have achieved substantial electricity coverage and are now transitioning to cleaner and renewable energy sources post the COVID-19 pandemic.

“Many have initiated ambitious projects to establish the world’s largest solar energy farms. Even countries without abundant mineral resources like Lithium are making substantial investments in charging infrastructure.

“The increasing stringency of emissions regulations in cities is driving the shift towards electric vehicles and electric powertrains, underscoring the imperative need for expanded charging networks and significant investment in EV technologies,” Tuggar concluded.

Meanwhile the President of the Africa Finance Corporation (AFC), Mr. Samaila Zubairu, has hinted that Africa requires about $250 billion annually to close the climate financing gap.

Zubairu, in his address, added that the high volumes of finance is required for sustainable infrastructure (clean energy and transport systems, green buildings, etc).

Zubairu, who was represented by the Senior Director, Africa Finance Corporation (AFC), Mr. Taiwo Adeniji, in his keynote address tagged: ‘Mobilizing Finance for Green Projects’, said that the bulk of these resources are expected to come from the private sector.

He said African governments have a responsibility to design and implement conducive policies and regulations to attract private investments, particularly in priority sectors for climate action and green growth.

According to him, ”African countries, particularly Nigeria, should consider utilizing innovative financing instruments and mechanisms to attract private sector financing. Instruments such as Social Bonds, Green Bonds and Loans, Sustainability Bonds and Loans, Cabon Pricing, Debt-for-Climate Swaps, etc. can and should be deployed to attract private financing.

“Multilateral Development Banks (MDBs) such as the World Bank Group, the African Development Bank Group, and Development Financing Institutions (DFIs), such as the African Export-Import Bank (Afreximbank) and the AFC, have key roles to play in attracting financing for green investments into Africa. In addition to the commercial financing that they provide, those that have the capacity and resources can provide grants, concessionary finance, credit and risk guarantees, etc., that support capacity development and de-risk African investments thereby making them attractive to private investors.

“In addition, a wide range of traditional financiers have designated part of their capital to focus on green projects. These include development vehicles from developed countries like Britain’s BII, the Netherlands FMO, Germany’s DEG and the United States’ DFC.

“Africa indeed holds the key to the world’s transition to a sustainable future, being the home to significant proportions of the key transition metals. Yet today, it not only pays the price for the climate indiscretion of the past, but also struggles in accessing the funds it needs to change the course for a better future.”

Zubairu further stated that: “One of the key paths towards the achievement of net-zero is significantly scaling up investments in green projects.